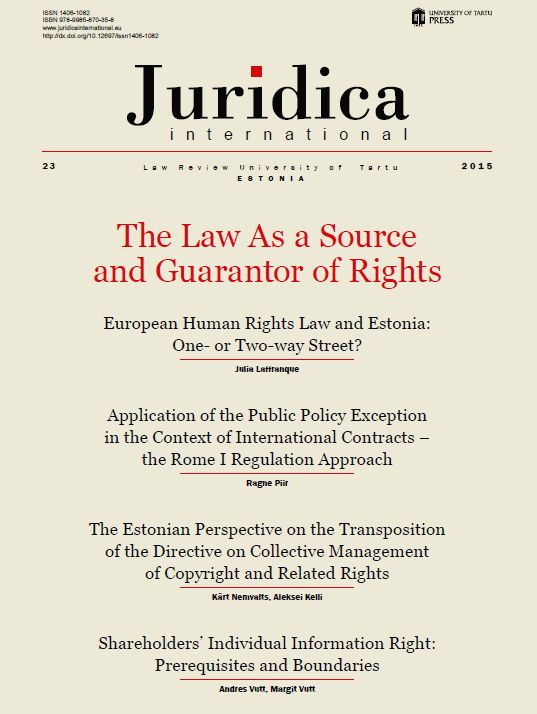

Available Options for Funding the Insolvency Proceedings of Corporate Debtors

DOI:

https://doi.org/10.12697/JI.2015.23.09Keywords:

Bankruptcy, insolvency, cost of bankruptcy proceedings, abatement of bankruptcy, public funding, official receiver, bankruptcy creditor, deposit payment (security deposit), post commencement financingAbstract

As a rule, corporate insolvency proceedings are financed from the debtor’s estate. To avoid the abatement of bankruptcy proceedings, other, extraordinary arrangements extending beyond this must be found when the estate is insufficient to cover the costs of the proceedings.

Such extraordinary arrangements are deposits by creditors, assistance from public funds, and post-commencement financing (loans), all of these aimed at financing the trustees’ activities in proceedings. It is necessary to have rules regulating the duties of the individuals responsible for the timely filing of corporate bankruptcy petitions in payment of the costs of the corresponding insolvency proceedings.

The author finds that in jurisdictions linking insolvency proceedings to a broader range of aims than only the best possible satisfaction of the creditors’ claims (including ascertaining the causes of insolvency), public funding for conducting the proceedings should be available. There is a possibility of combining several sources of funding to achieve the best possible result and fulfilment of multiple aims of insolvency proceedings.